Ultrafiltration is a core branch of membrane separation technology. Enterprise applys this product extensively across multiple fields including municipal water affairs, industrial water treatment, food and medicine, and new energy, by virtue of its superior performance such as 0.001-0.1 micron sieving accuracy, high efficiency and energy conservation, and convenient operation.

In recent years, tightening environmental policies and the urgent need for industrial upgrading have driven the steady expansion of the ultrafiltration market. The global ultrafiltration equipment market size exceeded US$9.5 billion in the third quarter of 2025 and is projected to reach US$14 billion by 2030. The market is currently in a phase of structural expansion, with ample room for growth.

This article will analyze the expansion potential of the ultrafiltration market from three dimensions: application scenarios, regional layout, and technological innovation, combining the current market situation and driving factors, and propose targeted suggestions.

Current Status of the Ultrafiltration Market

The global ultrafiltration market is currently experiencing steady growth, with demand primarily driven by municipal water services and industrial water treatment. On the supply side, the high-end market is dominated by European and American giants, while the mid-to-low-end market features diversified competition. Policy guidance, demand upgrades, and technological innovation are the three main drivers for continued market expansion.

At the policy level, major economies and emerging countries around the world are increasing their efforts in environmental protection and water resource management, which is forcing the large-scale popularization of ultrafiltration technology.

- The EU explicitly requires its member states to achieve a wastewater reuse rate of no less than 30% by 2030 through several environmental policies, and it is promoting ultrafiltration as a key technology for advanced wastewater treatment and reuse.

- The revised Clean Water Act in the United States further tightens the limits on industrial wastewater and municipal sewage discharge, prompting upgrades to existing water treatment facilities, with ultrafiltration becoming a core alternative to traditional filtration technologies.

- In addition, emerging economies such as India, Brazil, and Southeast Asia have also introduced new environmental regulations to support the development of the water treatment industry through tax breaks, R&D subsidies, and other means.

On the demand side, rigid demand in traditional sectors continues to be released, while incremental space in emerging sectors is becoming increasingly prominent.

Municipal water sector

The ultrafiltration penetration rate in municipal water supply systems in major European and American cities has exceeded 65%. Accelerated urbanization in emerging economies such as the Asia-Pacific and Latin America has led to a surge in new municipal wastewater treatment plant projects, driving a significant increase in demand for ultrafiltration equipment.

Industrial sector

Industries such as chemical engineering, new energy, and pharmaceuticals have an urgent need for high-purity water and wastewater resource recovery. By 2025, ultrafiltration accounted for 42% of global industrial wastewater treatment applications. The pharmaceutical industry in Europe and the United States widely uses inorganic ultrafiltration membranes, mainly ceramic membranes, whose acid and alkali resistance is suitable for pharmaceutical wastewater treatment. Although the price is 4-8 times that of ordinary PVDF membranes, the demand continues to rise.

Food and beverage sector

Countries like the US, Europe, and Japan have stringent requirements for the purity of water used in food processing. Ultrafiltration technology continues to expand its application in areas such as juice clarification and dairy product purification, becoming a significant growth driver in this niche market.

From a technological perspective, global ultrafiltration technology continues to iterate and upgrade, with European and American giants leading breakthroughs in core technologies and the supply chain becoming increasingly resilient.

International companies such as Dow and GE dominate the research and development of high-end ultrafiltration membranes, with product performance significantly ahead of the competition. European and American manufacturers hold over 70% of the global high-end market share, possessing significant advantages in supply chain and service, thus laying a solid foundation for the expansion of the ultrafiltration market.

Potential for Ultrafiltration Market Expansion

Application scenario expansion

The current ultrafiltration market is concentrated in municipal water services and industrial water treatment. Future core growth lies in expanding into more localized application scenarios and tapping into niche demands, with a focus on emerging economies and underserved markets in Europe and the US.

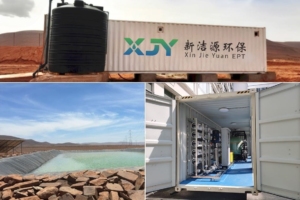

Traditional expansion into localized application scenarios primarily focuses on rural and decentralized water supply systems. However, regions like Africa, Southeast Asia, and Latin America face challenges such as dispersed populations, water pollution, fluctuating water quality, and insufficient maintenance capabilities. Ultrafiltration’s advantages of stable water output and ease of maintenance can be precisely addressed in these situations. For example, Wilo’s East Africa team has implemented an ultrafiltration rainwater recycling system in Kenya, solving the local water shortage problem. Furthermore, Ghent University in Belgium has developed a solar-powered ultrafiltration device that can recover urine resources without requiring a power grid.

Penetrating emerging scenarios requires a focus on high-value-added areas to create differentiated competitive advantages.

-

New Energy Sector

The global expansion of the lithium battery industry is driving a surge in demand for ultrapure water. Ultrafiltration, as a pretreatment method, can stably control SDI15 below 3, ensuring the operation of reverse osmosis systems. Currently, the industry penetration rate is less than 30%, indicating significant potential for expansion in Southeast Asian new energy industrial parks.

-

In the biopharmaceutical field

Europe, the United States, and Japan have stringent requirements for membrane cleanliness and biocompatibility. Leading international manufacturers offer specialized ultrafiltration membranes with protein adsorption rates of <2%, have obtained FDA and CE certifications, and dominate the high-end market. As industries shift to emerging economies, demand will continue to grow.

-

In the biopharmaceutical field

Europe, the United States, and Japan have stringent requirements for membrane cleanliness and biocompatibility. Leading international manufacturers offer specialized ultrafiltration membranes with protein adsorption rates of <2%, have obtained FDA and CE certifications, and dominate the high-end market. As industries shift to emerging economies, demand will continue to grow.

-

Other scenarios

The annual growth rate of data center cooling water recycling scenarios is expected to reach 12%, which will become a new engine for overseas market expansion.

Regional market expansion

The global ultrafiltration market can focus on expanding into emerging economies such as the Asia-Pacific and Latin America. The Asia-Pacific region will contribute nearly 45% of market growth, with countries like India and Southeast Asia facing significant water shortages and increasingly stringent environmental regulations, resulting in strong demand.

China’s ultrafiltration equipment boasts significant advantages in cost-effectiveness and supply chain, and can leverage the Belt and Road Initiative to expand exports of complete sets of equipment. Meanwhile, China has achieved technological breakthroughs in high-end ultrafiltration membranes, and can gradually penetrate the high-end markets of Europe and America through technological cooperation and brand acquisitions, thereby increasing its global market share.

Driven by technological innovation

Technological innovation is the core driving force for the continued expansion of the ultrafiltration market. In the future, the focus should be on “cost reduction, efficiency improvement, and quality enhancement” to promote technological upgrades and business model innovation, breaking through market expansion bottlenecks.

Technological upgrades should prioritize breakthroughs in high-end membrane materials and system integration technologies. Currently, China still relies on imports for ultrafiltration membranes in high-end applications such as electronic-grade ultrapure water and aseptic pharmaceuticals. We need to ramp up R&D investment to develop specialized fouling-resistant membrane materials with high flux and long lifespan, including graphene-modified membranes, and elevate their flux stability to 1.8 times the industry average.

How should we view the expansion of the ultrafiltration market?

Despite the vast potential for expansion in the ultrafiltration market, numerous challenges remain, requiring targeted countermeasures.

First, market competition is intensifying, putting pressure on small and medium-sized manufacturers to exit the market. Competition is concentrated in the low-to-mid-end segment, with frequent price wars. Meanwhile, international giants continue to expand their presence in the Chinese market, further exacerbating competition. Countermeasures: Companies need to focus on differentiated competition, deeply cultivate niche scenarios such as rural water supply and new energy water treatment, and develop unique solutions. Simultaneously, they should promote product transformation towards higher added value and green technologies, obtaining ISO and CE certifications to align with policy guidance and seize market opportunities.

Second, the standards system is incomplete, and regional market entry barriers vary. Globally, standards for ultrafiltration membrane product performance testing and system design and installation are not yet fully unified. Rising trade protectionism in some regions hinders market expansion. Differences in water quality standards and policy requirements across regions increase the cost of regional expansion for companies. Countermeasures: Actively participate in international and domestic standard setting to promote standard unification. Conduct in-depth research on policy guidance and market demand in different regions, optimize regional expansion strategies, strengthen cooperation with local governments and enterprises, and lower market entry barriers.

Conclusion

As a core sector in environmental protection and water resource utilization, the ultrafiltration market possesses vast potential for expansion, driven by multiple favorable factors including policy support, upgraded demand, and technological innovation.

In the future, market expansion should focus on application scenarios, promoting the penetration of traditional and emerging applications. It should leverage regional strategies to cultivate niche markets and explore emerging global markets. Furthermore, it should be driven by technological innovation to achieve performance upgrades and business model iterations.